For a century, the sign of a “stable” business was a massive, brick-and-mortar headquarters owned outright. In the volatile market of 2026, that heavy infrastructure is no longer an asset; it is an anchor that drowns liquidity and kills agility.

We need to have a serious conversation about “sunk costs.” In the old economy, pouring millions of dollars into a concrete foundation was seen as a prudent investment. You built a factory or a warehouse, and you sat in it for at least forty years.

The Myth of Permanence

Let’s cut straight to the chase here. That world of permanent structures is gone. Markets today shift overnight. Supply chains reroute based on geopolitical hiccups or climate events. If your capital is buried in the ground in a location that no longer serves your logistics network, you are dead. You are paying property taxes on a monument to a business model that expired three years ago.

The modern CFO isn’t looking for permanence. They are looking for “Fluid Assets.” They want infrastructure that behaves like software: scalable, deployable and, most importantly, movable. The goal is to separate the operational capacity from the geography. You need the ability to house your inventory or your production line, but you shouldn’t be married to the dirt underneath it.

The Fabric Solution to a Hardware Problem

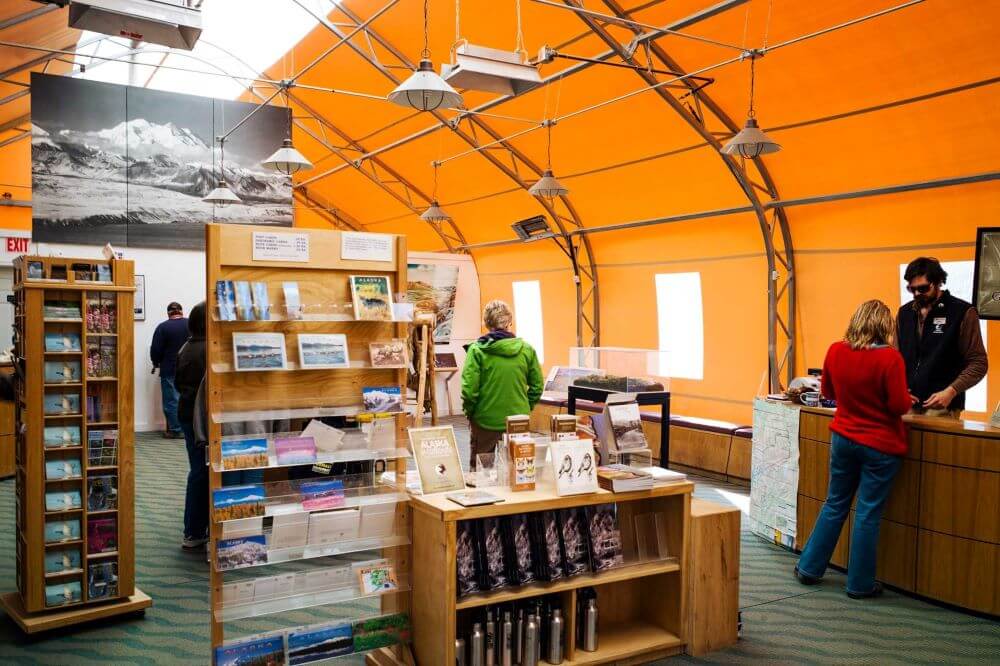

This is where the shift in industrial architecture changes the balance sheet. We aren’t talking about “tents” here. We are talking about high-performance engineering that rivals steel but without the handcuffs.

Smart enterprises are turning to the commercial fabric building as a way to bypass the “Concrete Trap.” These structures offer the same durability and weather protection as a traditional metal building, but they are treated differently by both the tax code and the logistics manager. Because they are technically portable, they can often be classified as equipment rather than real estate, offering accelerated depreciation benefits.

But the real value is in the agility. If a mining operation in Nevada dries up, you don’t abandon the building. You pack it up and move it to the new site in Arizona. If a retail distribution hub needs to expand for the holiday season and shrink in February, you aren’t stuck with empty square footage. You have an asset that breathes with the revenue stream.

Speed as a Financial Instrument

Time is the one thing you cannot buy, but you can certainly waste it waiting for permits. Traditional construction is a bureaucratic nightmare of zoning boards, steel shortages and weather delays. Every month your project sits in the “planning phase” is a month of lost revenue.

Agile infrastructure collapses this timeline. You can go from a handshake to an operational facility in weeks, not years. This “Speed-to-Market” capability allows businesses to capture emerging opportunities before competitors even break ground.

We see this dynamic playing out in the current startup ecosystem, where the ability to pivot physical operations is just as critical as pivoting digital strategies. The companies winning market share are the ones that can physically manifest their presence in a new region instantly. They don’t wait for the perfect building to become available; they bring their own.

The Energy Equation

There is also a functional argument to be made about operating costs. Old industrial buildings are energy vampires. They are dark, drafty and expensive to light.

Modern engineered structures utilize translucent membranes that allow natural light to flood the workspace during the day. This slashes electrical costs significantly. It seems like a minor line item until you multiply it across 50,000 square feet over five years. Then, it becomes a competitive advantage.

Furthermore, the pressure to reduce carbon footprints is hitting the industrial sector hard. Investors are scrutinizing energy efficiency. A structure that requires less steel to build and less electricity to run is not just cheaper; it is an ESG asset that looks good in the quarterly report.

The Verdict: Liquidity is King

The romantic notion of the “cornerstone” is dead. In 2026, the most valuable ability a business has is the ability to leave.

If your capital is tied up in immovable objects, you are vulnerable. If your capital is invested in high-performance, relocatable assets, you are dangerous. The market rewards the fleet-footed. It punishes the stationary. Look at the rusted hulks of old factories littering the Rust Belt. Those were once considered “permanent” assets. Now? They are just liabilities with a zip code.

Stop burying your money in the ground. Don’t build the next ruin; build a toolkit. When the economic winds shift, you want to be the one packing up the tent and chasing the profit, not the one left explaining to shareholders why you are anchored to a ghost town. The future of industrial real estate isn’t about where you are today; it’s about how fast you can be somewhere else tomorrow.